Sales Tax & Renting Short Term: What You Didn’t Know

Sales Tax & Renting Short Term: What You Didn’t Know

SALES TAX isn’t sexy, and usually isn’t a topic that gets brought up when you’re talking about short-term rentals. This is probably because Airbnb, the company most people immediately associate with renting short term, charges sales tax to the guest and automatically remits it for you, the host. You never have to worry about it. But if you’re just using Airbnb, you may not be maximizing your income. You may not be making as much from your rental as you could be. There are other short term rental sites out there, sites that hosts might want to consider renting through also, and each of these operates a bit differently.

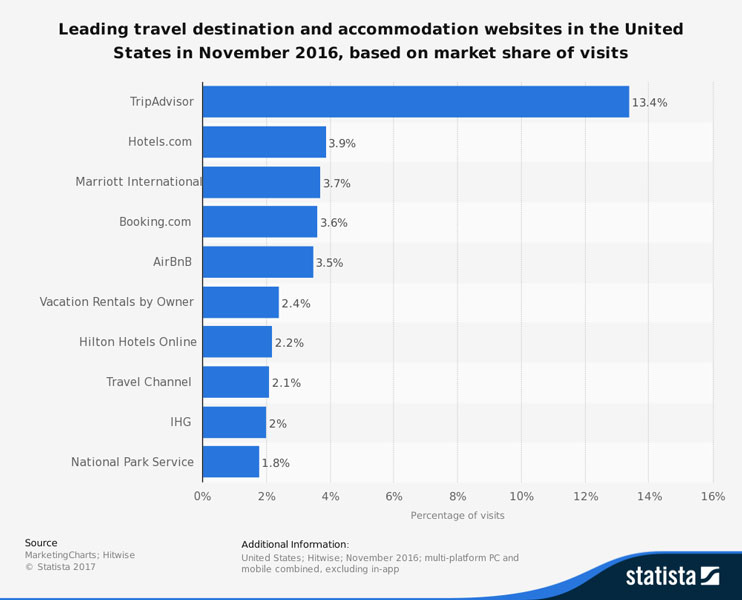

As you can see from the graph below, in November 2016 Airbnb’s share of website visits only made up 3.5% of the Leading Travel Destination and Accommodation websites. Although, Airbnb’s market share has grown in 2017, you still are not maximizing the amount of traffic flowing through your listing if you’re just using Airbnb.

If you really wanted to maintain the highest occupancy rates and earn the most income on your short-term rental, marketing your listing on other popular short-term rental sites is the way to go. TripAdvisor/Flipkey, VRBO/HomeAway, and Booking.com all open your listing up to a much wider audience. We’re finding that while Airbnb makes up the largest portion of our clients’ bookings, 25% – 50% of bookings come from the other sites. By default, we list our managed rentals on as many platforms as possible.

The only catch: none of these sites automatically pay these necessary taxes like Airbnb does. It’s up to you to pay your city and probably your state their shares of your hard-earned profits. In our case, operating for the most part in Colorado Springs, Colorado, the city gets 5.13% and the State 5.12% for each stay. You’ll even need to pay taxes on your cleaning fees or risk the ire of your local tax gorilla. For our rentals, this represents a fairly substantial figure of 10.25%. At this percentage rate, that tax liability can grow pretty quickly. You’ll need a sales tax license with your city and your state as well—a process that isn’t ridiculously hard to complete, but certainly one more thing (among many) to keep in mind with your short term rental.

At Hostē, we market your listing across all of these sites, acquire your sales tax license for you, and remit the sales tax to the city and state, just like Airbnb does. All sales tax is charged to your guests, so you never have to worry about it. We even pay for your yearly sales tax renewal fees, all out of our flat management percentage. Easy for us, and easy for you.